- Brokers HOT

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims

- Expo

- Event

- Awards

Download

Download

Are You Ready for the February 2025 Swap Rate Analysis?

Brokersview has conducted an in-depth assessment of Avg swap rates offered by leading brokers in Singapore for February 2025, providing valuable insights for traders seeking cost-efficient long-term strategies.

Summary of Avg Swap Spread for EUR/USD, GBP/USD, and XAU/USD

Platforms with Relatively Low Fees (Ranked 1-3):

- AUS Global

- GO Markets

- Doo Prime

Avg Swap Rate Analysis for EUR/USD, GBP/USD, and XAU/USD

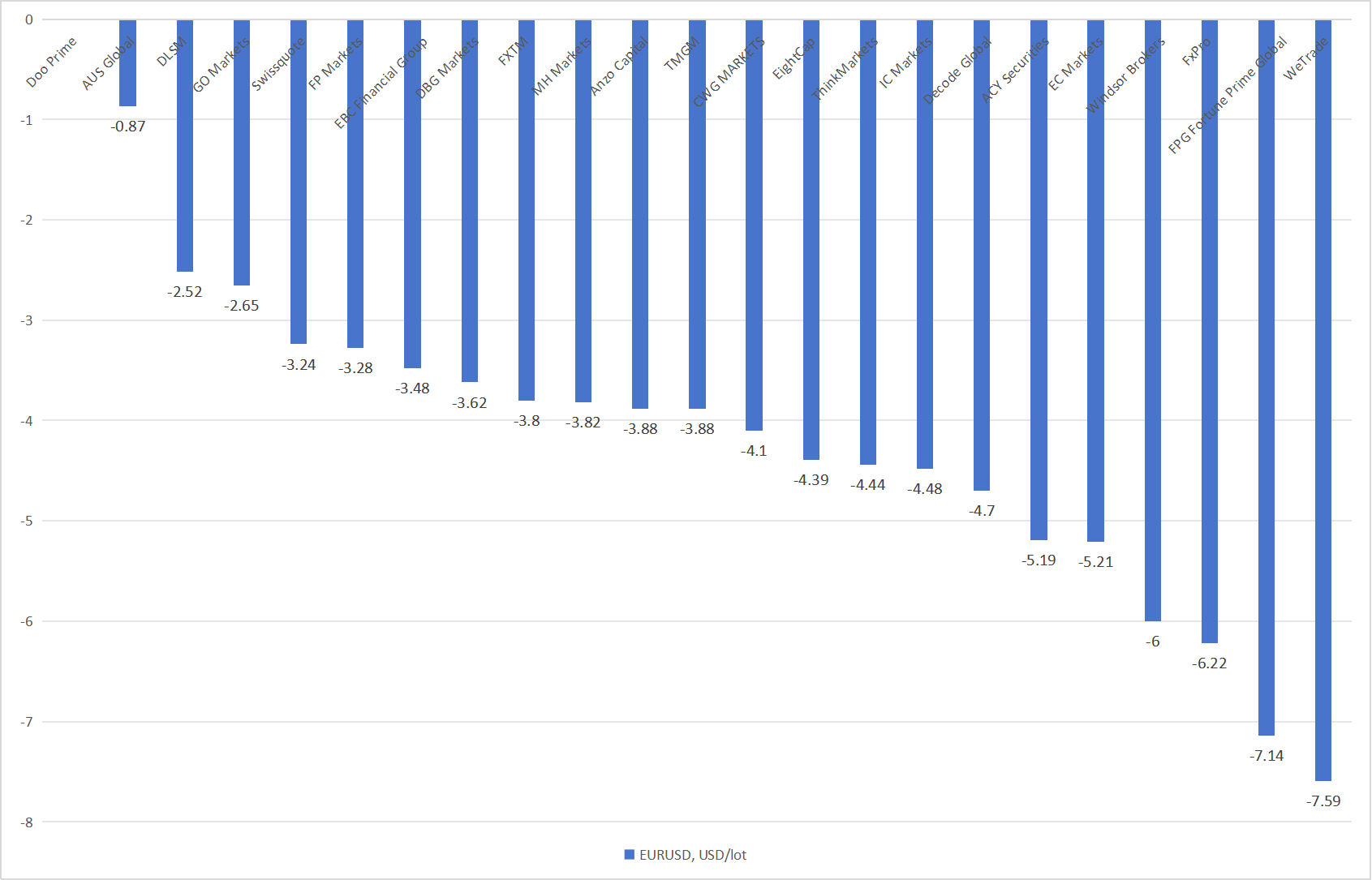

EUR/USD Avg Swap Rate Analysis

For traders holding EUR/USD positions, the most competitive Avg swap rates in February 2025 are as follows:

-

Doo Prime: 0 USD/lot

-

AUS Global: -0.87 USD/lot

-

DLSM: -2.52 USD/lot

-

GO Markets: -2.65 USD/lot

-

Swissquote: -3.24 USD/lot

Doo Prime offers zero swap fees, making it an ideal choice for both short-term and long-term traders. AUS Global also provides a relatively low negative swap rate, appealing to cost-sensitive traders.

GBP/USD Avg Swap Rate Analysis

For GBP/USD traders, the following brokers offer more favorable Avg swap rate conditions:

-

Doo Prime: 0 USD/lot

-

AUS Global: -1.1 USD/lot

-

CWG MARKETS: -1.88 USD/lot

-

FP Markets: -1.98 USD/lot

-

MH Markets: -2.22 USD/lot

Doo Prime again provides zero swap fees, making it an attractive option for traders looking to avoid additional costs for long-term positions. AUS Global and CWG MARKETS also offer relatively low negative swap rates, making them suitable for position traders.

XAU/USD Avg Swap Rate Analysis

Gold trading typically has higher swap fees. The brokers with the lowest Avg swap rates for XAU/USD in February 2025 are:

-

CWG MARKETS: -11.59 USD/lot

-

DLSM: -17.57 USD/lot

-

FPG Fortune Prime Global: -17.79 USD/lot

-

AUS Global: -17.8 USD/lot

-

MH Markets: -18.06 USD/lot

CWG MARKETS offers a relatively low swap fee, making it a competitive choice for gold traders. Meanwhile, DLSM, AUS Global, and other platforms have higher swap fees, making them more suitable for short-term traders or those who trade less frequently.

Conclusion

- AUS Global offers relatively low swap costs for major currency pairs and remains competitive in gold trading.

-

Doo Prime provides zero swap fees for EUR/USD and GBP/USD, making it ideal for long-term traders.

Since swap rates fluctuate based on market conditions, traders should always check real-time data to select the broker that best aligns with their trading strategy.For more comprehensive evaluation data, please check the BV evaluation column.