- Brokers HOT

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims

- Expo

- Event

- Awards

Download

Download

Brokersview Singapore February 2025 Assessed: Are You Getting the Best EUR/USD, GBP/USD, and AUD/USD Spreads?

In the forex trading industry, spreads play a crucial role as they represent the trading costs borne by investors. BrokersView has carefully compared the average spreads of the three major trading instruments (EUR/USD, GBP/USD, and XAU/USD) among 23 of the most popular forex brokers in the market. This comprehensive analysis aims to help traders find the most suitable forex trading platform in just three minutes.

Spread Comparison Method

This analysis is based on data from February 1 to February 28, 2025, evaluating the average spreads of EUR/USD, GBP/USD, and XAU/USD for 23 brokers to assist traders in choosing the best trading platform.

Top 3 Brokers with the Lowest Spreads

-

AUS Global: EUR/USD 2.1 point, GBP/USD 7.9 point, XAU/USD 6.2 point.

-

Decode Global: EUR/USD 11.1 point, GBP/USD 12.5 point, XAU/USD 17.8 point.

-

ThinkMarkets: EUR/USD 11.6 point, GBP/USD 13 point, XAU/USD 20.3 point.

February EUR/USD Average Spread Comparison

As the most traded currency pair, EUR/USD typically enjoys lower spreads. However, actual spreads may vary depending on the trading platform, market volatility, and trading hours.

Brokers with relatively stable average spreads include:

-

IC Markets: Average spread of 0.7 point, maximum spread of 151 point.

-

AUS Global: Average spread of 2.1 point, maximum spread of 150 point.

-

Doo Prime: Average spread of 10.2 point, maximum spread of 25 point.

In this February EUR/USD spread test, most platforms experienced short-term spread widening.

February GBP/USD Average Spread Comparison

GBP/USD has relatively higher spreads, influenced by market liquidity, volatility, and brokers' pricing strategies.

Brokers with relatively stable average spreads include:

-

IC Markets: Average spread of 2.6 point, maximum spread of 160 point.

-

AUS Global: Average spread of 7.9 point, maximum spread of 202 point.

-

Decode Global: Average spread of 12.5 point, maximum spread of 174 point.

In this February GBP/USD spread evaluation, most platforms showed short-term spread widening.

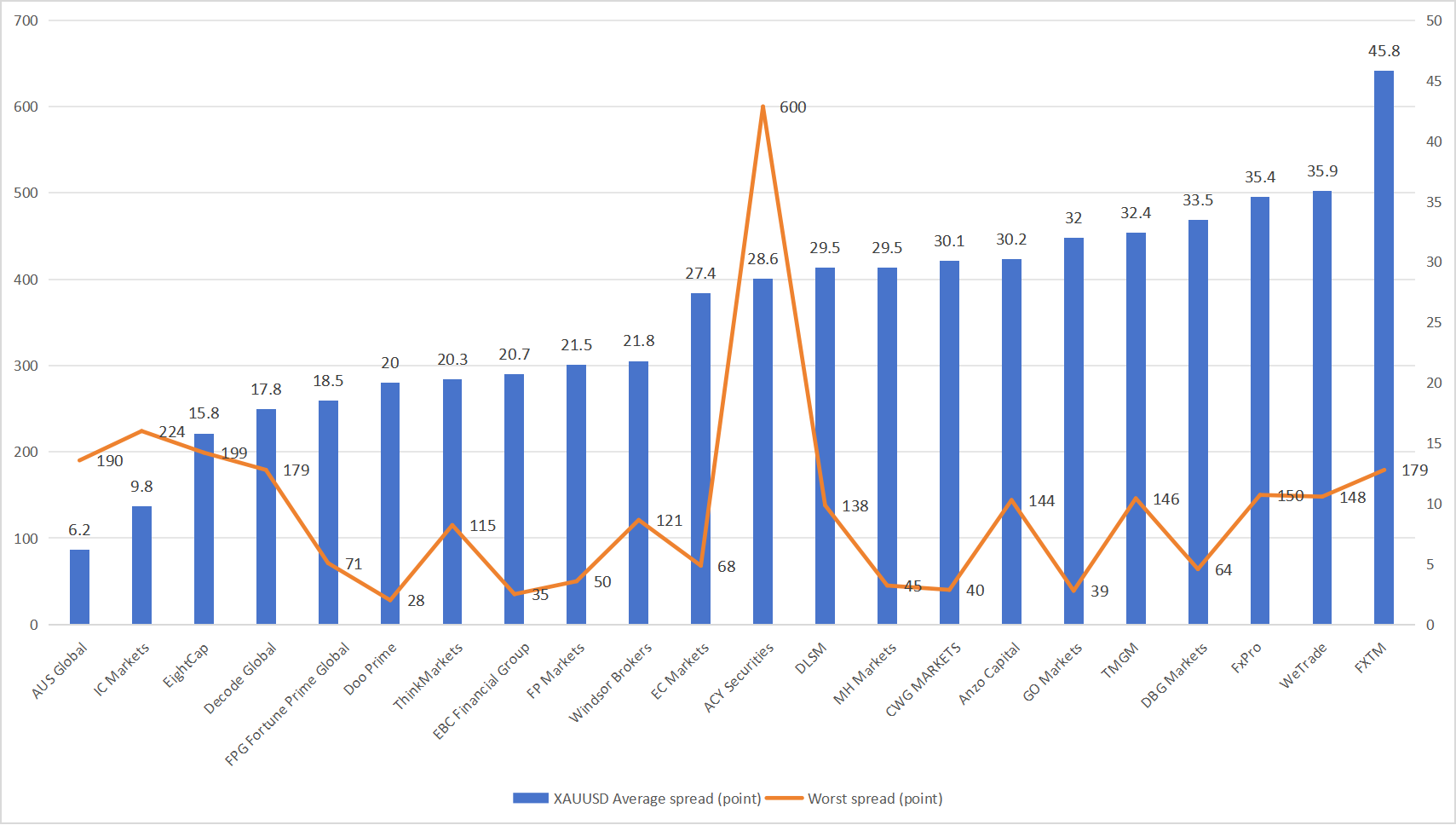

February XAU/USD Average Spread Comparison

Gold trading spreads are generally higher than major currency pairs and are affected by market liquidity and trading strategies.

Brokers with relatively stable average spreads include:

-

AUS Global: Average spread of 6.2 point, maximum spread of 190 point.

-

IC Markets: Average spread of 9.8 point, maximum spread of 224 point.

-

EightCap: Average spread of 15.8 point, maximum spread of 199 point.

In this February XAU/USD spread test, most platforms experienced short-term spread widening.

Conclusion & Recommendations

It is important to note that spreads are not fixed and may fluctuate depending on market liquidity, volatility, trading volume, and brokers' pricing strategies. When market liquidity is sufficient and conditions are stable, spreads may narrow; however, they may widen during major news events or periods of high volatility.

BrokersView's detailed analysis aims to provide traders with essential data to make informed decisions when selecting a forex trading platform that aligns with their strategies and goals. For a more comprehensive evaluation, please refer to the BV assessment.