- Brokers HOT

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims

- Expo

- Event

- Awards

Download

Download

FXMeridian Review: the Data-driven European Social Trading Platform

FXMeridian, a data-driven online trading platform, recognized for its technical approach and commitment to supporting traders with high-quality information and lightning fast execution speeds. Their data-first approach has been well-established for over 10+ years now with their platform opening way back in 2015 offering a broad set of trading tools, financial instruments and services. By combining cutting-edge market analytics with attentive personal account managers (PAM), FXMeridian strives to give retail traders the informational edge needed to be competitive on the global markets. The company provides traders access to an extensive asset class via its CFD platform, including CFDs on forex, commodities, indices, stocks, crypto and more.

In this review, we will delve deeper into FXMeridian’s edge, the pros and cons of using their platform, and how it may compare to other CFD trading platforms on the market.

Overview of FXMeridian

FXMeridian positions itself as a well-rounded solution for retail traders seeking a blend of advanced market insights and user-friendly tools. With a selection of over 2000+ assets, the platform caters to both new and seasoned traders. A core strength lies in its emphasis on market research and analytics, enabling users to make use of technical strategies and adapt quickly to shifting market trends.

Key Highlights:

- Data-Driven Approach: FXMeridian invests in advanced analytics, real-time data feeds, and research tools to keep traders informed.

- Personal Account Managers (PAM): Dedicated experts offer guidance and customized strategies, ensuring every user feels supported in their trading journey.

- Educational Resources: An array of webinars, tutorials, and market insights fosters continual learning.

Multiple Regulations: The most important part for any budding trader is the safety of their funds and the coverage provided to them by the regulators. FXMeridian is regulated by multiple financial authorities worldwide, including the: Financial supervision Commission (Register number RG-03-08), MISA (Reference number BFX2024173). The company is also registered under the MiFID regulations with a lot of European regulators – AFM France, AFM Netherlands, ASF Romania, ATVP Slovenia, BaFin Germany, CBI Ireland, CMVM Portugal, CNB Czech Republic, CNMV Spain, CONSOB Italy, CSSF Luxembourg, CySEC Cyprus, HANFA Croatia, FI Sweden, FKTK Latvia, FMA Austria, FSA Denmark, FSA Estonia, FSA Finland, FSMA Belgium, KFN Poland, Lietuvos Bankas Lithuania, MFSA Malta, MNB Hungary, VFSC (Reference number 14,691). This wide-range of regulators ensures that the platform adheres to industry standards and all Know your Customer (KYC) and Anti-Money Laundering (AML) protocols in Europe.

Account Types and Registration

FXMeridian’s onboarding process to open accounts is straightforward and simple, requiring personal details and a document verification (ID and address verification). A minimum deposit of €150 (or equivalent) is required to start live trading. The platform supports various payment methods such as:

- VISA/MasterCard Credit Card

- VISA/MasterCard Debit Card

- Paypal

- Bank/Wire Transfers

- Crypto Transfers

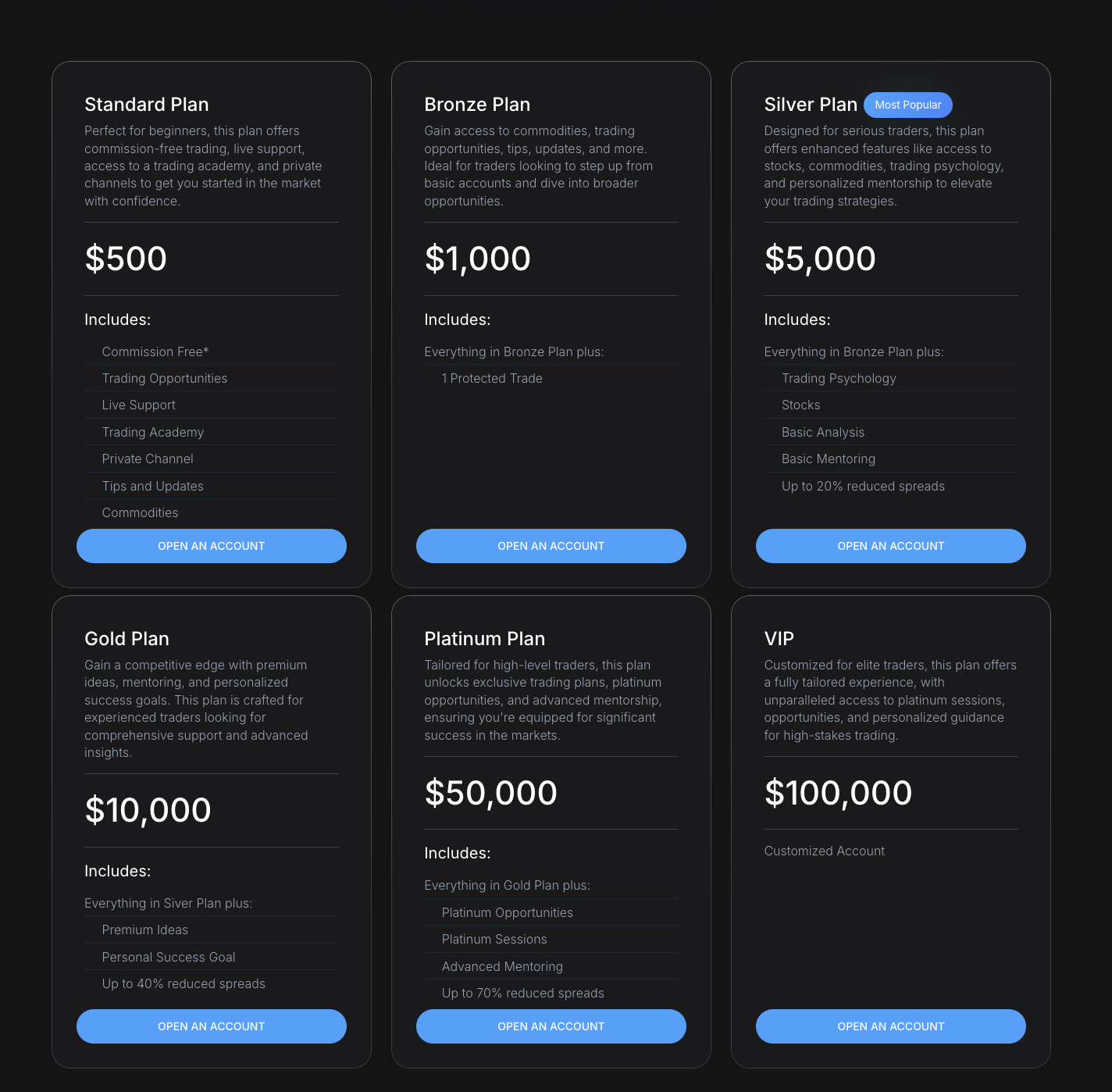

The best part about opening an account with FXMeridian is the additional benefits you can get access to by choosing one of the specified plans:

Trading Tools Available

One FXMeridian’s defining feature is its informational edge which shows itself in its extensive market data and technical analysis tools for its wide range of Trading Instruments. The platform offers:

- Market Insights and Research: Regularly updated reports and analyses offer a clear understanding of market trends, helping traders spot potential opportunities.

- Real-Time Data Feeds: Swift, accurate price quotes and live economic calendars aim to support timely decision-making alongside a news section for fast sentimental analysis.

- Comprehensive Analytics Tools: Users can access charting packages, technical indicators (RSI, MACD,EMA, etc.) , and fundamental data to refine their trading strategies on the fly.

Other key features include:

- Market Alerts:Traders can set alerts based on price changes, percentage changes, and other metrics. Notifications can be sent via email or push notifications.

- Economic Calendar: Helps traders stay informed of major market events, including interest rate changes, inflation reports, and more.

- News Insights: A unique feature that helps traders explore market trends and make data-driven decisions. This tool uses internal data to provide valuable insights into market sentiment and activity.

- Risk Management Tools: FXMeridian provides users with a variety of risk management tools like stop-loss orders, trailing stops, and guaranteed stops, all aimed at protecting positions from adverse market movements.

- Webinars: Available for certain plans, these educational sessions help traders deepen their understanding of market trends and trading strategies.

Additional Support

FXMeridian’s commitment to personalized assistance is evident through its Personal Account Manager service and Social Trading Functions. Each trader can benefit from:

- Tailored Guidance: PAMs provide relevant updates, best practices, and strategic tips aligned with individual trading styles.

- Regular Check-Ins: Scheduled calls or messaging sessions facilitate ongoing communication, ensuring traders remain well-supported in their goals.

- Prompt Issue Resolution: Account-related questions and platform assistance are handled by professionals who understand each client’s trading profile.

- This one-on-one support structure enhances the overall user experience, making it especially appealing to those who value an interactive, human touch in their trading journey

- Social Trading

Trading Instruments Available

One of FXMeridian’s other strong points is the extensive selection of trading instruments, which include:

- CFDs (Contract for Difference): The primary focus of FXMeridian, with over 2000 instruments available for trading.

- Forex:Currency pairs, with leverage up to 1:100 on major pairs, leverage of 1:33 on exotics and 1:50 for certain minor pairs on the forex market.

- Shares: Leverage up to 1:20 on stocks from various global exchanges. Commodities: Leverage of up to 1:100 for trading physical assets like wheat, gold, and silver with oil at 1:50 leverage.

- ETFs (Exchange-Traded Funds):Leverage up to 1:20, with access to multiple ETF assets.

- Indices: Leverage up to 1:1-0, with indices like the S&P 500, FTSE100 and Germany 40.

- Cryptocurrencies: Instruments with leverage up to 1:20, allowing traders to speculate on crypto price movements.

The platform also offers futures trading and swaps available on the U.S. markets .This provides access to a broad range of futures contracts, enabling traders to speculate on the price movements of commodities, stock indices, and more.

Trading Fees and Costs

FXMeridian, unlike other brokers, does not charge commission fees on trades, this is perfect for those looking to minimize costs. Instead, the platform earns revenue through the spread, which is the difference between an asset's buying and selling prices. The spread is dynamic and varies depending on market conditions, but this simplicity appeals to traders who don’t want to deal with additional fees per trade. You can see the full spread list here: https://www.fxmeridian.com/service-details/#spreads

- Overnight Funding:If a position is held overnight, an interest fee (either added or subtracted) may apply depending on the instrument being traded. This is a standard practice in CFD trading.

- Currency Conversion Fee: A standard 0.5% fee is charged when trading instruments are denominated in a currency other than the trader’s account currency, however we reimburse those fees after they occur.

- Inactivity Fee: We do not have any form of inactivity fees on our platform. You can set it and forget it. Come back after a year and simply withdrawal your funds.

- Guaranteed Stop Order: This unique feature guarantees a stop loss level on certain positions, but it comes with a wider spread, which might be considered an indirect fee.

Thanks to these competitive spreads and commission-free model FXMeridian is an attractive platform for many european retail traders.

Pros:

Data-Driven Platform

0 Fees and Commission-Free trading

Wide-range of Trading Tools

Multiple Regulatory Licenses

Personal Account Managers

Social-Trading Functions

Educational Materials

Cons:

Long Customer Support Ques

Targeted for Traders

High Deposit for premium Account Plans

Conclusion:

Overall FXMeridian is a tried and tested data-driven trading platform that can help retail traders find their edge. Its broad selection of trading instruments, low spreads, personal account management and social trading make it the perfect choice for traders looking to take the next step in their trading journey. While the high deposit fees might turn some traders away, those that decide to stick with FXMeridian will be rewarded with an extensive data-first approach to trading and full support on their journey. The platform’s transparency, easy of use and additional resources make it a strong choice in the world of online trading. Whether you’re looking to start trading or already have experience, FXMeridian offers a well-rounded trading platform that is hard to beat.