- Brokers HOT

- Scam

- BV Assessment NEW

- Rankings

- Regulators

- News

- Claims

- Expo

- Event

- Awards

Download

Download

Unveiling the Shadows: The Dark Story of Amega in the World of Online Trading

In the world of boundless opportunities, online trading has become captivating for seasoned investors and eager newcomers. However, amidst the allure, a lurking presence haunts the industry—a name that resonates with deceit and infamy: Amega. Join us on an expedition as we delve into the complex web this notorious scam broker spun, shedding light on their manipulative strategies and the unfortunate individuals ensnared in their trap.

Amega - A Quick Overview

Amega Global Ltd which claims to be a regulated investment company authorized by the Mauritius Financial Services Commission, entices investors with promises of low-cost trading, instant cashback, lightning-fast execution, and high leverage. They boast ultra-low spreads, a no-commission fee structure, and the freedom to employ any trading strategy. Additionally, they offer a loyalty cashback program and an enticing A-MEGA bonus. While presenting access to advanced trading platforms, such as MT5 and Web Terminal, behind these enticing claims lies a darker truth—a web of treacherous tactics Amega employs, leaving unsuspecting victims in their wake.

Is Amega Regulated?

No, despite Amega Global Ltd's claim of being an authorized and regulated investment company under the Financial Services Commission Mauritius, our meticulous investigation revealed the company has no evidence of its existence or registration with the provided license number GB22200548.

Clientele Feedback

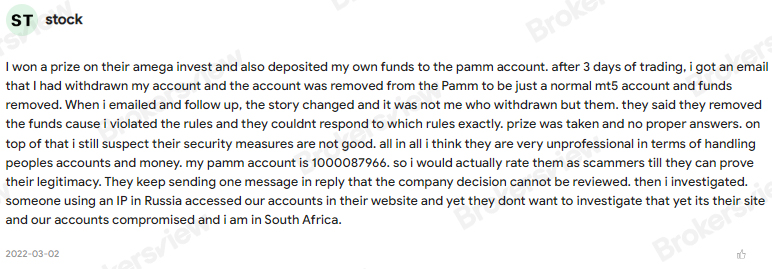

Customer feedback regarding Amega Global Ltd raises severe concerns about the company's handling of accounts, funds, and verification processes.

Clients have reported incidents where their accounts were withdrawn and funds were removed without their consent, and explanations from Amega were inconsistent and lacking clarity.

Additionally, suspicions have been raised regarding the company's security measures and allegations of unauthorized account access.

Traders have expressed dissatisfaction with the termination of contracts once they start earning profits and the non-payment of funds as per the offer agreement.

Some clients have also criticized the company for lacking transparency and providing vague reasons for alleged violations of the company’s policies.

What Makes Amega A Scam?

Amega exhibits several characteristics that contribute to its reputation as a scam broker:

It falsely claims to be regulated, misleading potential clients into believing it operates under a legitimate authority.

There have been documented instances of broker violations and abnormal records, further eroding trust in the company.

The Securities Commission Malaysia has issued a warning and added Amega to its Investor Alert List due to the firm engaging in unlicensed capital market activities.

Concerns about Amega's data harvesting practices have also been raised, potentially putting clients' personal and financial information at risk.

Bottom Line

In light of Amega's questionable practices, including false regulation claims, broker violations, and data harvesting concerns, it is highly recommended that traders approach this company with extreme caution. While exploring reputable alternatives in the financial market is advisable, seeking insights from trusted sources like BrokersView can provide valuable guidance in making informed investment decisions.