Preface

To ensure the accuracy, objectivity and reliability of our assessment results as much as possible:

1. All the assessment data is derived from real trading orders by using real accounts.

2. A broker will be assessed three times in Singapore, Dubai and Frankfurt, respectively.

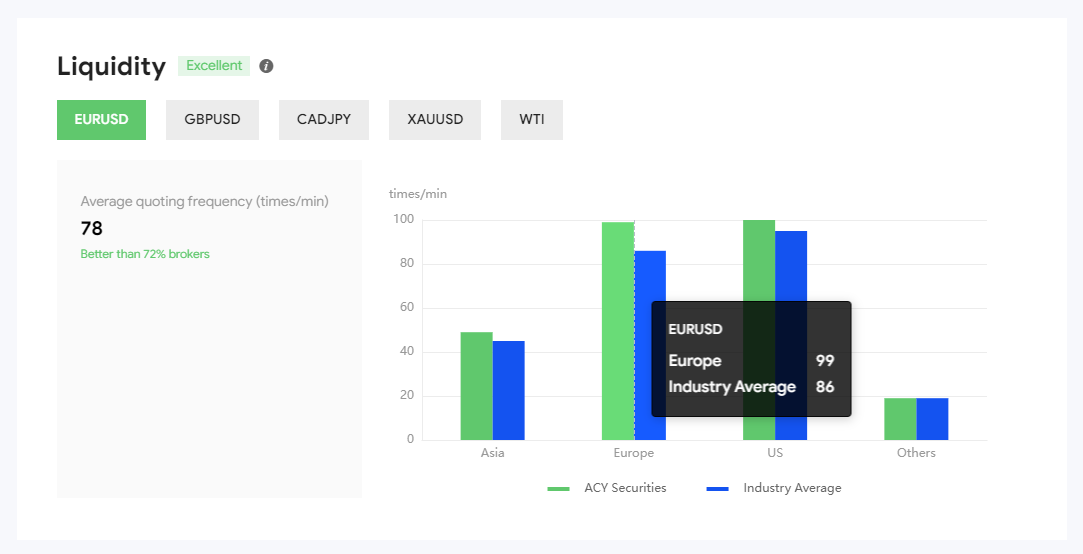

3. We assess brokers based on six dimensions: trading speed, stability, liquidity, spreads, slippage and swap rates. The total score is 100 points, with 20 for trading speed, 10 for stability, 10 for liquidity, 20 for spreads, 30 for slippage and 10 for swap rates.

In the future, we will expand our assessment to cover more dimensions, more brokers, and more regions. Watch this space!

Comments