Daily Technical Analysis: [22 APR]

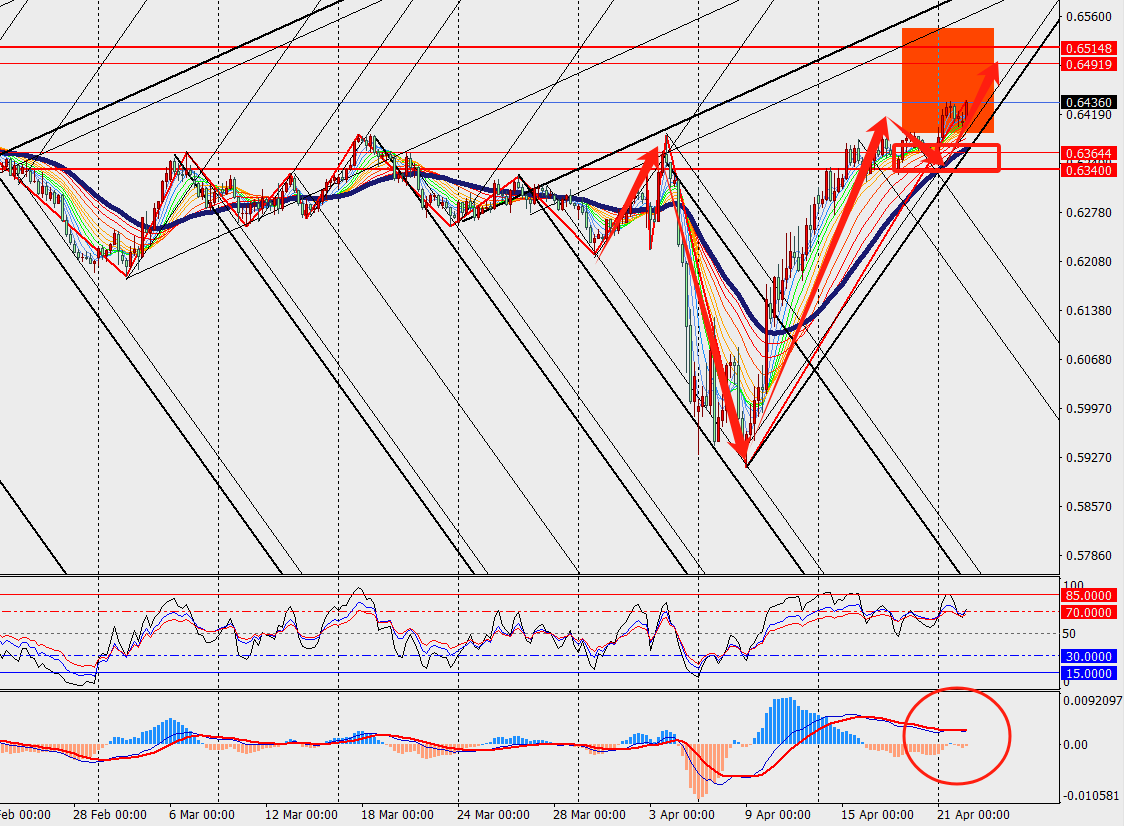

1. AUD/USD Analysis:

News Summary:

The minutes of the meeting released by the Reserve Bank of Australia sent a hawkish signal, emphasizing that the specific time for the next interest rate adjustment cannot be determined at this stage. Policymakers made it clear that the next decision is not preset, but they all agreed that the May meeting would be a more appropriate time to reassess, which provided important support for the Australian dollar. At the same time, the US dollar was under pressure overall and was near its low since April 2022.

Trend Analysis:

We can see AUD/USD hovered at a high level and ran above the 48 hours moving average on H4 chart. In addition, the MACD double line and energy bar expand above the zero axis. The buy limit could be used, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [0.6350]

Key Resistance Levels: [0.6500]

Pivot Points [0.6400]

2. Gold Analysis:

News Summary:

The Wall Street Journal reported that gold prices are unstoppable, and some investors are betting that the rally will continue, and these options could pay off if prices continue to rise. Late last week, call option trading tied to the world's largest gold ETF soared to an all-time high. The frenzied trading highlights the intense fear, and the turbulence is almost inevitable. U.S. stocks are plummeting, as are U.S. Treasuries and the dollar.

Trend Analysis:

We can see gold continues to hit new highs and runs above the 48 hours moving average on H4 chart. However, the MACD double line and histogram bar gradually expand above the zero axis. The buy limit could be placed, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [3450]

Key Resistance Levels: [3500]

Pivot Points [3460]