Daily Technical Analysis: [28 APR]

1. GBP/USD Analysis:

News Summary:

Trump's mild comments on tariffs and Fed policy eased the safe-haven demand for the dollar, and the pound took the opportunity to rebound. At the same time, the uncertainty of British economic data and the central bank's policy outlook added variables to the trend of the pound. Combined with the latest fundamental and technical signals, the pound has shown a certain degree of resilience in the short term, but the medium-term trend still needs to be confirmed by key economic data and policy signals.

Trend Analysis:

We can see GBP/USD H4 level oscillated and fell and ran below the 48 hours moving average. On the other hand, the MACD double line and histogram bar expand near the zero axis. The sell limit could be used, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [143.80]

Key Resistance Levels: [146.40]

Pivot Points [145.70]

2. AUD/USD Analysis:

News Summary:

The US dollar index retreated to around 99.50, which created some upside for the Australian dollar. An important factor contributing to this change is the easing of trade tensions between the United States and other economies. In addition, the increased likelihood of a rate cut by the Reserve Bank of Australia at its May policy meeting may put pressure on the Australian dollar. Due to the increasing downside risks to inflation and global economic growth, the RBA may cut the official cash rate by 25 basis points to 3.85% in May.

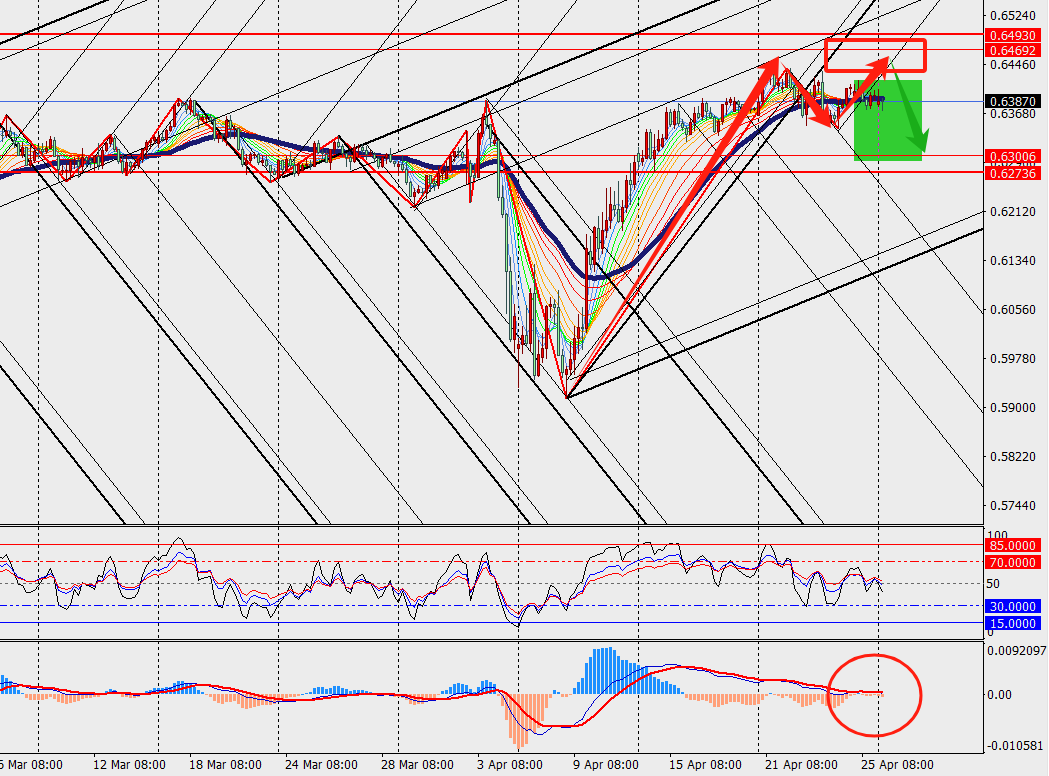

Trend Analysis:

We can see AUD/USD hovered at a high level and ran below the 48 hours moving average on H4 chart. In addition, the MACD double line and energy bar expand near the zero axis. The sell limit could be placed, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [1962]

Key Resistance Levels: [2030]

Pivot Points [2012]