- Nhà môi giới HOT

- Scam

- BV Đánh giá NEW

- Bảng xếp hạng

- Cơ quan quản lý

- Tin tức

- Bảo vệ quyền

- Triển lãm HOT

- Sự kiện

- Giải

Tải xuống

Tải xuống

Daily Technical Analysis: [11 APR]

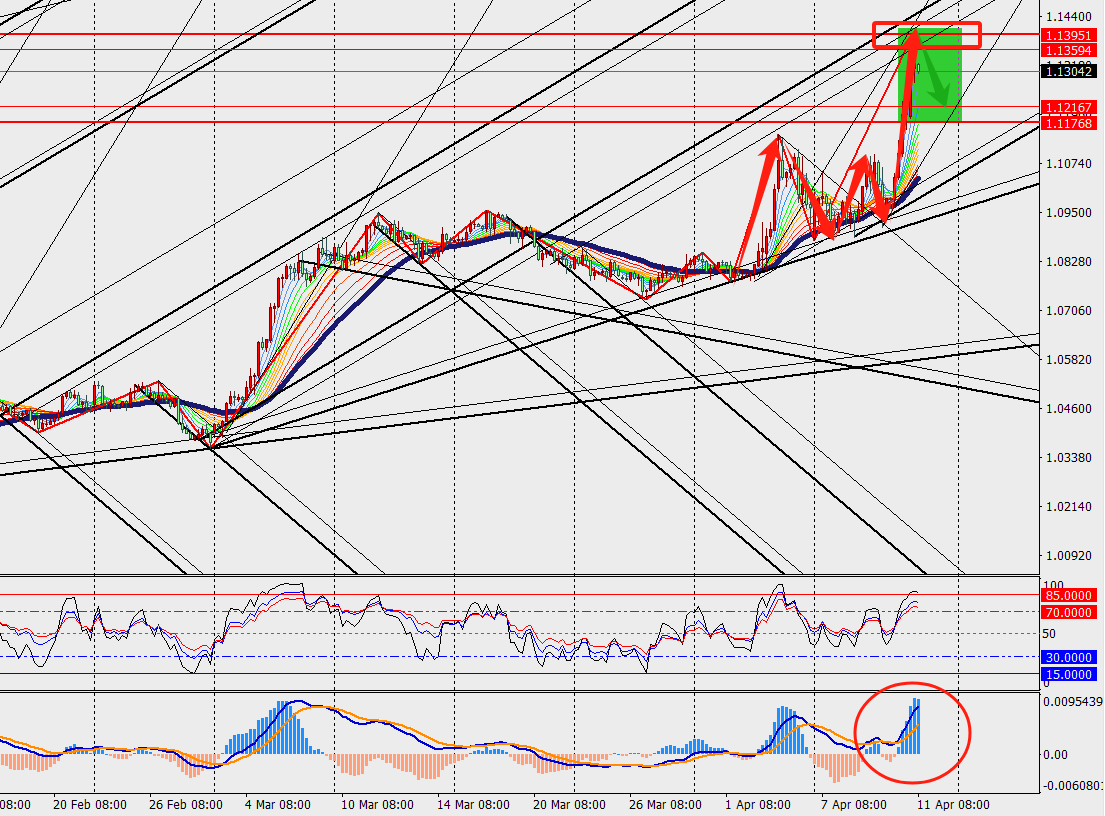

1. EUR/USD Analysis:

News Summary:

After US President Trump announced a 90-day suspension of reciprocal tariffs on countries that do not take retaliatory actions, the EU announced that it would put its retaliatory measures against the United States on hold for 90 days. The President of the European Commission said that he had noted US President Trump's statement and would put these measures on hold for 90 days while the EU took countermeasures. According to the original plan, some EU tariffs will take effect on April 15, and another batch of tariffs will be implemented in mid-May.

Trend Analysis:

We can see EUR/USD rose sharply and ran above the 48 hours moving average on H4 chart. In addition, the MACD double line and energy bar expand above the zero axis. Owing to the overbought state, the sell limit could be used, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [1.1200]

Key Resistance Levels: [1.1380]

Pivot Points [1.1340]

2. Gold Analysis:

News Summary:

Data on Thursday showed that U.S. consumer prices unexpectedly fell in March, but inflation risks were tilted to the upside. Gold's safe-haven appeal has resurfaced, returning to its track of record highs. The US dollar index fell more than 1%, making gold cheaper for investors holding other currencies. The unexpected slowdown in U.S. inflation has dragged the dollar down, and the international trade war continues to push investors to safe-haven gold.

Trend Analysis:

We can see gold H4 level hit a new high and ran above the 48 hours moving average. Furthermore, the MACD double line and histogram bar expand above the zero axis. The sell limit could be placed, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [3167]

Key Resistance Levels: [3255]

Pivot Points [3240]